finance

EuroMed Venture Capital investments 2023 recap

2023 has proven to be a bumper year for world economies. Inflation, international security and instability have plagued the year. The flipside to turmoil is the creation of pockets of opportunities. In 2023 EuroMed went into overdrive with its Venture Capital department and doubled down its proprietary investments in fintech companies and affiliation. The department…

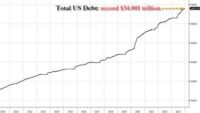

Read MoreUS Debt Hits A Record $34.001 Trillion

The US Treasury has a morbid habit of revealing big, round numbers of debt around major calendar milestones, and the new 2024 year was no different because according to the latest Treasury Daily Statement published after the close today and reflecting the US Treasury’s financial statements as of Dec 29, 2023, total US debt as…

Read MoreGerman Energy Giant Warns Europe Remains Exposed To Natural Gas Supply Shocks

Despite reducing significantly its dependence on Russian gas, Europe remains exposed to natural gas supply and price shocks as it lacks any buffers in the system, the CEO of Germany’s top utility, RWE, told the Financial Times. “But we are not where we need to be because we shouldn’t have an energy supply system which is…

Read MoreFrom bears to bulls to AI booms

Bears did it again? The massive move lower in the AAII bull – bear spread (outlined here) has resulted in markets squeezing lately. Nothing new, but frustrating for the crowd. Source: Refinitiv Smart money Smart or not, but they missed the latest squeeze… Source: Barclays Buyback ATH 29% of global stocks are buying back their shares,…

Read MoreJPMorgan Chase to spend $200 million on carbon dioxide removals

LONDON, May 23 (Reuters) – U.S. bank JPMorgan Chase & Co (JPM.N) will spend over $200 million on carbon dioxide removal credits to take away and store 800,000 tons of emissions as part of its sustainability efforts, it said on Tuesday. Even with pledges of huge reductions in emissions, many scientists believe extracting carbon dioxide (CO2) by…

Read MoreEurope Agrees To Remove Energy Support Stimmies To Cut Budget Deficits

In a move that could send Europe into an even a deep recessionary tailspin and crush the continent’s long-suffering consumers, should Europe’s energy problems extend into the new year – which they almost certainly will – last Thursday Euro zone finance ministers agreed to withdraw energy support measures to their economies and use the savings to…

Read MoreAmazon To Invest $100M In Generative AI Center

Amazon To Invest $100M In Generative AI Center

Read MoreGermany And The EU Are Hopelessly Behind On EVs & Artificial Intelligence

The EU is hopelessly behind the US and China on technology that will lead the future. It will stay that way… Sleepwalking Into Oblivion Eurointelligence has an interesting article on how Germany is Sleepwalking Into Oblivion. Current policy debates are rightly focused on the consequences of global bifurcation. But perhaps an even bigger danger for the EU is…

Read MoreAlphabet Shares Slide On Report Samsung Abandoning Google For Bing

Shares of Alphabet slid during premarket trading in New York on Monday following a New York Times report on Sunday that revealed South Korean consumer electronics giant Samsung was considering replacing Google with Microsoft’s Bing as the default search engine on its devices. NYT said Google’s employees were “shocked” when they heard about the news in March.…

Read MoreUBS May Slash 36,000 Positions Following Credit Suisse Takeover

The forced bail-in sale of Credit Suisse to UBS will lead to a staggering number of job cuts, ranging from 20% to 30%, which equates to a reduction of approximately 25,000 to 36,000 positions, as reported by SonntagsZeitung newspaper, quoting insiders. Earlier this month, UBS agreed to acquire its struggling competitor Credit Suisse for 3 billion Swiss francs ($3.3…

Read More