US Debt Hits A Record $34.001 Trillion

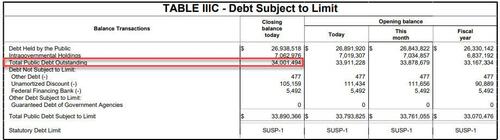

The US Treasury has a morbid habit of revealing big, round numbers of debt around major calendar milestones, and the new 2024 year was no different because according to the latest Treasury Daily Statement published after the close today and reflecting the US Treasury’s financial statements as of Dec 29, 2023, total US debt as of the end of the year was – drumroll – just over $34 trillion for the first time ever, or $34,001,493,655,565.48 to be precise.

Since this is a topic we have covered more or less daily for our 15 year existence, we don’t need to say much suffice to show a chart of total US debt since zerohedge launched in Jan 2009, when total US debt was only $10.6 trillion. We sure have gone a long way since then.

Some context: US debt increased by…

- $1 trillion in the past 3 months

- $2 trillion in the past 6 months

- $4 trillion in the past 2 years

- $11 trillion in the past 4 years

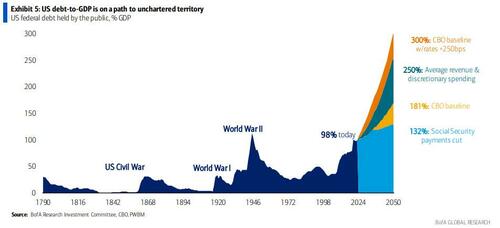

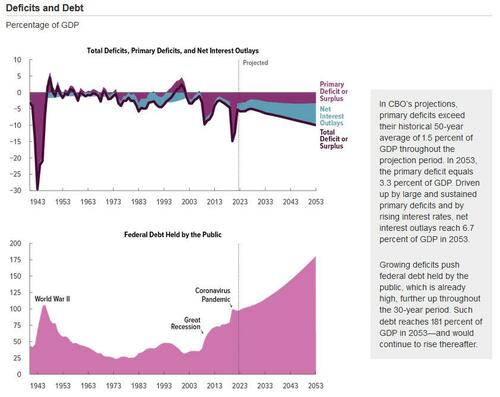

… and so on. You get the exponential picture. At this point everyone knows how this ends – certainly the CBO does…

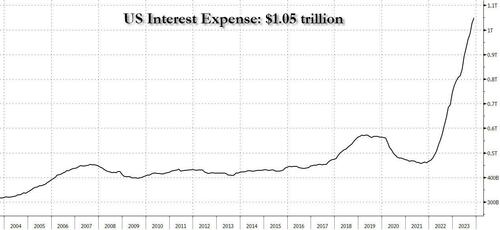

… but since there is no way to reverse the catastrophic outcome, there is no point in even talking about it. At best, one may only prepare for the inevitable hyperinflationary outcome, which would be good news to what is now over $1 trillion in interest expense: after all, someone has to devalue the currency all that interest is payable in.

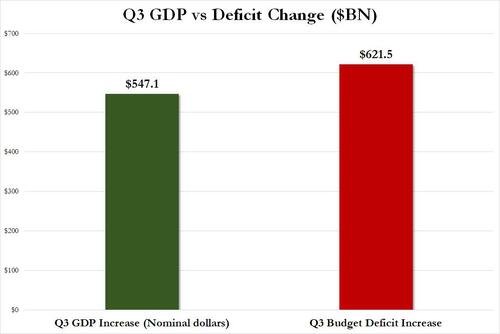

And since there is no longer a way out, we may as well joke about it so consider this: in the third quarter when US GDP supposedly grew at a 4.9% annualized rate – hardly the stuff of recessions – rising $547 billion in nominal (not real) dollars, the US budget deficit increased by a whopping $622 billion.

This not only explains where US “growth” has come from, but begs the question just how much debt will be needed when the US falls into an official recession.

Or actually not, because at this point the best anyone can do is polish the brass on the titanic while waiting for the inevitable, captures so vividly by the following endgame chart.